Unlock the Conveniences: Offshore Depend On Services Described by an Offshore Trustee

Offshore trust services have ended up being increasingly prominent amongst people and businesses seeking to enhance their financial techniques. From the fundamentals of offshore counts on to the ins and outs of tax obligation preparation and property defense, this overview checks out the different advantages they provide, including improved personal privacy and discretion, versatility and control in wealth monitoring, and accessibility to worldwide financial investment chances.

The Essentials of Offshore Trusts

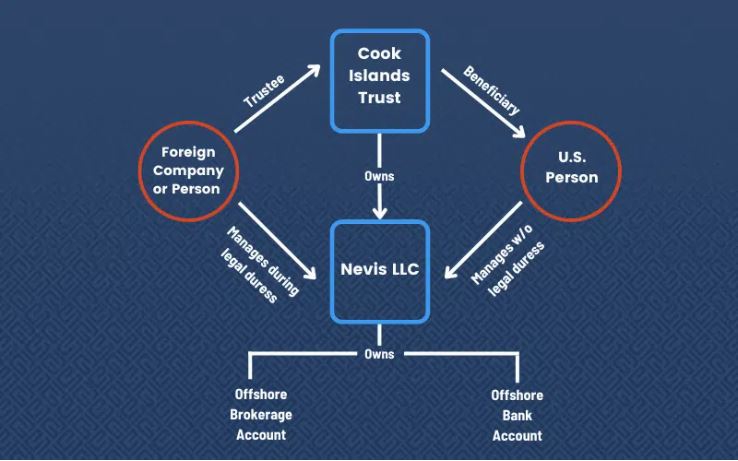

The basics of offshore depends on include the facility and administration of a rely on a jurisdiction beyond one's home nation. Offshore counts on are often made use of for possession protection, estate preparation, and tax optimization objectives. By putting properties in a depend on located in an international jurisdiction, people can ensure their properties are protected from prospective risks and liabilities in their home nation.

Establishing an overseas count on typically calls for involving the services of an expert trustee or count on business who is fluent in the regulations and regulations of the picked territory. The trustee acts as the lawful proprietor of the assets held in the trust fund while managing them based on the terms laid out in the count on act. offshore trustee. This arrangement gives an added layer of defense for the possessions, as they are held by an independent 3rd party

Offshore counts on supply a number of benefits. They can give enhanced privacy, as the details of the count on and its beneficiaries are commonly not openly disclosed. Secondly, they supply potential tax advantages, as certain territories may have a lot more favorable tax programs or use tax obligation exemptions on certain sorts of revenue or properties held in depend on. Overseas depends on can help with efficient estate preparation, enabling individuals to pass on their wealth to future generations while decreasing inheritance tax obligation obligations.

Tax Preparation and Property Protection

Tax preparation and property protection play a vital duty in the tactical usage of overseas depends on. Offshore trust funds provide individuals and services with the possibility to minimize their tax obligation obligations lawfully while securing their assets.

Asset security is an additional essential element of offshore count on services. Offshore trusts give a robust layer of defense versus potential dangers, such as lawsuits, lenders, or political instability. By moving properties into an offshore trust fund, individuals can secure their wide range from possible lawful claims and ensure its conservation for future generations. Additionally, overseas counts on can offer privacy and personal privacy, more securing possessions from prying eyes.

Nonetheless, it is necessary to note that tax planning and asset security ought to constantly be carried out within the bounds of the law. Participating in illegal tax obligation evasion or deceptive property security strategies can bring about severe effects, including penalties, charges, and damages to one's online reputation. It is vital to look for expert suggestions from knowledgeable overseas trustees that can direct people and services in structuring their offshore trusts in a honest and compliant way.

Boosted Privacy and Privacy

Enhancing personal privacy and confidentiality is an extremely important objective when using overseas trust fund services. Offshore depends on are renowned for the high degree of personal privacy and discretion they provide, making them an eye-catching option for services and people looking for to shield their properties and economic info. Among the crucial benefits of offshore depend on services is that they offer a lawful framework that enables people to maintain their economic events exclusive and shielded from prying eyes.

The boosted personal privacy and confidentiality offered by overseas counts on can be specifically beneficial for people who value their personal privacy, such as high-net-worth people, stars, and professionals looking for to secure their assets from possible claims, creditors, and even household disputes. By making use of offshore trust solutions, individuals can keep a greater degree of privacy and privacy, enabling them to safeguard their wealth and economic passions.

However, it is vital to note that while overseas trust funds supply boosted privacy and confidentiality, they must still comply with relevant regulations and regulations, including anti-money laundering and tax reporting requirements - offshore trustee. It is important to deal with seasoned and reliable offshore trustees and legal experts who can ensure that all lawful responsibilities are met while making best use of the privacy and confidentiality advantages of offshore trust solutions

Adaptability and Control in Wide Range Administration

Offshore trusts supply a substantial level of flexibility and control in wealth management, enabling individuals and organizations to efficiently handle their assets while keeping privacy and privacy. Among the essential advantages of offshore depends on is the capacity to tailor the depend on structure to fulfill specific requirements and purposes. Unlike conventional onshore trusts, offshore trusts supply a variety of choices for property security, tax obligation planning, and sequence planning.

With an offshore depend on, people and companies can have better control over their wealth and exactly how it is taken care of. They can choose the jurisdiction where the depend on is developed, allowing them to benefit from positive regulations and policies. This adaptability enables them to enhance their tax obligation position and shield their assets from potential dangers and liabilities.

Moreover, overseas depends on offer the choice to assign expert trustees that have you could check here comprehensive experience in taking care of intricate trusts and browsing worldwide laws. This not only makes sure reliable riches monitoring however also supplies an added layer of oversight and safety and security.

Along with the versatility and control provided by overseas trust funds, they also offer discretion. By holding properties in an offshore jurisdiction, businesses and people can secure their monetary information from spying eyes. This can be specifically beneficial for high-net-worth people and services that value their privacy.

International Financial Investment Opportunities

International diversity supplies people and companies with a wide range of investment possibilities to expand their portfolios and reduce dangers. Buying international markets permits financiers to access a wider series of possession classes, sectors, and geographical areas that may not be readily available locally. By expanding their financial investments across different countries, financiers can reduce their exposure to any type of Read Full Report single market or economy, hence spreading their dangers.

One of the essential advantages of global financial investment possibilities is the potential for higher returns. Different countries may experience differing financial cycles, and by buying multiple markets, financiers can utilize on these cycles and possibly accomplish greater returns compared to investing solely in their home country. Additionally, spending worldwide can additionally give accessibility to arising markets that have the capacity for quick financial development and greater investment returns.

Additionally, global financial investment opportunities can give a hedge against money risk. When spending in foreign money, financiers have the possible to benefit from money fluctuations. For instance, if an investor's home currency weakens against the money of the international investment, the returns on the investment can be enhanced when transformed back to my sources the financier's home currency.

However, it is essential to note that investing globally likewise includes its own set of risks. Political instability, regulatory changes, and geopolitical uncertainties can all affect the performance of international investments. It is essential for investors to carry out detailed research and seek expert advice before venturing right into worldwide financial investment possibilities.

Verdict

The essentials of offshore trusts include the facility and administration of a trust fund in a territory outside of one's home country.Developing an offshore trust commonly requires involving the services of a specialist trustee or trust firm who is skilled in the laws and guidelines of the chosen jurisdiction (offshore trustee). The trustee acts as the legal proprietor of the assets held in the depend on while managing them in accordance with the terms established out in the count on act. One of the key advantages of overseas counts on is the capability to tailor the depend on framework to satisfy details requirements and objectives. Unlike standard onshore counts on, offshore trusts give a broad range of alternatives for asset defense, tax obligation planning, and sequence planning